Hong Kong International Airport (HKIA) is poised for take-off. With several projects underway-including the third runway and the Three Runway System (3RS) planned for commissioning in the coming year and 2024 respectively, the Premium Logistics Centre expected to be ready in two years, and SKYCITY which will be completed in phases between 2021 and 2027-it is embarking on a journey of transformation. With HKIA evolving into an aviation hub, Hong Kong the Airport City will enchant the world.

Fred Lam: Strengthening Hong Kong’s Position as an International Aviation Hub

Having developed by leaps and bounds since opening in 1998, HKIA now ranks among the best and busiest airports in the world. The Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area clearly states that HKIA must move with the times to realize Hong Kong’s vision to reinforce and improve its position as an aviation and airfreight stronghold.

Having developed by leaps and bounds since opening in 1998, HKIA now ranks among the best and busiest airports in the world. The Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area clearly states that HKIA must move with the times to realize Hong Kong’s vision to reinforce and improve its position as an aviation and airfreight stronghold.

Fred Lam, Chief Executive Officer of Airport Authority Hong Kong, points out that HKIA has grown into a well-developed international aviation center in recent years. He finds it encouraging that the Hong Kong and Macau chapter of the “14th Five-year Plan” expresses support for Hong Kong to reinforce its position as an international aviation hub. “We must fully capitalize on this positioning to meet the Central Government’s expectation.” He stresses that mid-term and long-term development plans of the Airport City blueprint will bolster HKIA’s function as an international aviation hub and transform it into a new local landmark through strategic development. It will create new momentum to propel the economic growth of both Hong Kong and the Greater Bay Area.

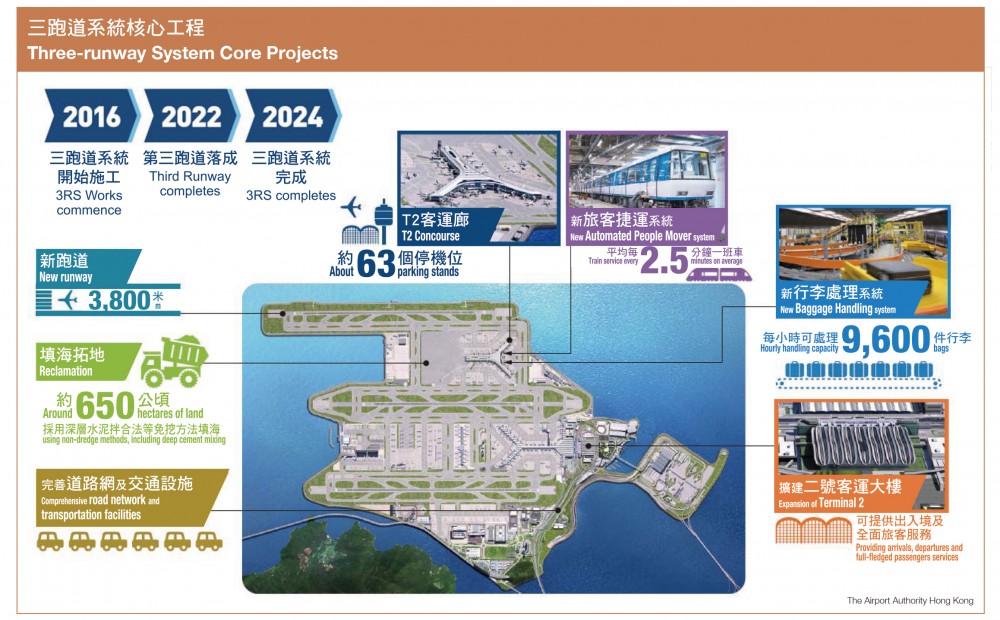

Lam says the 3RS project is a core component of Airport City. It involves the formation of 650 hectares of land north of the airport island by reclamation, the construction of the third runway, taxiways and associated infrastructure, as well as the expansion of Terminal 2 and building the T2 Concourse. Reclamation work is essentially complete now and he is confident the new runway can commence operation next year as scheduled while the entire 3RS project will be ready for delivery by the end of 2024 as planned and within budget.

An innovative airfreight model

To reinforce its airfreight leadership, HKIA is making major efforts to develop high value-added air cargo services to fully exploit e-commerce opportunities. One example is handling temperature-controlled goods (including pharmaceuticals and vaccines). According to Lam, a Premium Logistics Centre is being developed at HKIA by a joint venture spearheaded by Cainiao Network, the logistics arm of Alibaba Group. Scheduled for operation in 2023, the facility is expected to create an additional air cargo tonnage of 1.7 million tons per annum. Meanwhile, the DHL Central Asia Hub expansion project will be completed in the coming year, resulting in 50% increase in freight capacity to a total of 1.06 million tons.

Lam indicates that an HKIA Logistics Park is planned in Dongguan to take full advantage of opportunities in the Greater Bay Area. There will also be an airside intermodal cargo handling facility at HKIA’s third runway new reclamation zone to create a brand-new mode of cargo business, increase cargo handling volume and drive dynamic growth of the industry. These facilities will serve as a growth engine for Dongguan’s manufacturing industry. “In the future, customs clearance, security screening, palletization, cargo acceptance and other services for Mainland exports could be done in Dongguan before shipping goods to the cargo handling facility in the restricted area of HKIA by sea for air transshipment to worldwide destinations. As for airfreight imports to the Mainland, goods could be shipped directly from the airside intermodal cargo terminal to Dongguan. The entire process will be compliant with Hong Kong’s air cargo security regulations.

A new airport landmark

Another project-SKYCITY-is a key part of the Airport City development. In particular, “11 SKIES” will be Hong Kong’s largest integrated retail, dining and entertainment complex. 11 SKIES will be completed in phases between 2022 and 2025, introducing over 800 shops with more than 120 dining concepts, the biggest indoor entertainment area in Hong Kong and three Grade A office buildings.

Lam adds that Phase II development of AsiaWorld-Expo (AWE) will progress in parallel, giving Hong Kong its largest indoor performance venue with a seating capacity of 20,000. Upon completion, the total gross floor area of AWE’s exhibition facilities will increase to 100,000 square meters to work in synergy with its neighbor “11 SKIES”.

Lam believes that as the pandemic stabilizes and air travel gradually resumes normal operation, Airport City projects will come on board one after another in the next few years. They are likely to strengthen HKIA’s position as an international aviation hub and drive the economic growth of Hong Kong and the Greater Bay Area.

Cheung Waiman: Rising Airfreight Demand Fuels e-commerce Opportunities

Although the global aviation sector has been hard hit by COVID-19, figures published by the Airport Authority show that air traffic is stable and trending up. Notably, HKIA’s passenger traffic in June grew 40.1% year-on-year to 83,000 passengers, while cargo volume grew 11.5% year-on-year to 399,000 tons. Flights handled by HKIA increased 10.9% from the same month last year, clocking 11,050 flights in total.

Air cargo demand continues to grow

Cheung Waiman, Director of Asian Institute of Supply Chains & Logistics, CUHK, points out that while passenger traffic has fallen sharply due to the outbreak of COVID-19, cargo and other logistics figures are not affected. Cargo volume has seen steady increase. “Although passenger traffic dropped 80% to 90% due to the pandemic, we have seen the start of an e-commerce trend that supports online shopping and other consumer activities. Demand for staple goods and food air cargo has seen increasing growth.” Given this wax and wane effect, impact on the aviation industry has been limited.

In the wake of business opportunities presented by cross-border online shopping, Cheung says many airlines have retrofitted their passenger jets into air freighters to get a piece of the airfreight market. Even so, supply is not sufficient to meet demand. He stresses that geographically Hong Kong is well placed at the center of the Asia Pacific region. It is a gateway to the thriving Mainland market. With a well-developed aviation network and supporting facilities, we can offer point-to-point direct flights and versatile air passenger and cargo transshipments. He expects Hong Kong to attract substantial overseas investment and there are great business opportunities.

In the wake of business opportunities presented by cross-border online shopping, Cheung says many airlines have retrofitted their passenger jets into air freighters to get a piece of the airfreight market. Even so, supply is not sufficient to meet demand. He stresses that geographically Hong Kong is well placed at the center of the Asia Pacific region. It is a gateway to the thriving Mainland market. With a well-developed aviation network and supporting facilities, we can offer point-to-point direct flights and versatile air passenger and cargo transshipments. He expects Hong Kong to attract substantial overseas investment and there are great business opportunities.

Twin-track development of airfreight and shipping to maximize advantage

Neighboring cities like Guangzhou and Shenzhen have launched ambitious projects to expand airport supporting facilities. Some say they will become major competitors of HKIA. In Cheung’s opinion, Hong Kong’s client base is different from that of Guangzhou and Shenzhen so there should not be vicious competition.

He continues to say that Hong Kong’s shipping and airfreight are developing in parallel, and our logistic processes are more flexible. These are definite strengths. Unlike the Mainland model that does not allow transport mode changes en route, cargo shippers can ship their goods to Hong Kong by sea and switch to air transport, or vice versa.

“Hong Kong is blessed with geographical advantage and extensive transport connections. Government policies are flexible and diverse. It is a backdrop that enables twin-track development of the aviation and shipping industries to realize an average transport advantage. In effect, one plus one is greater than two.” To transport investors who are exposed to the risk of delivery delays, such a versatile approach is appealing beyond compare.

Proposed air cargo restricted zone in the Greater Bay Area

The opening of Hong Kong-Zhuhai-Macao Bridge (HZMB) presents opportunities of further collaboration between Greater Bay Area airports. Cheung suggests to lease land in Greater Bay Area cities close to HKIA to set up an air cargo zone that operates under HKIA rules and regulations. With this solution, we can meet the ever-growing air cargo demand and absorb the manpower supply of neighboring cities, reduce operating cost and address the manpower shortage issue. It can also save the cost of providing land at the airport through reclamation. He believes, with today’s cargo tracking technology, point-to-point real-time 24/7 transport reporting would not be any problem. It would offer adequate protection to cargo in transit.

Cheung stresses that by consolidating Zhuhai Airport’s Mainland aviation network and HKIA’s international network, we can enhance the Greater Bay Area’s overall competitive edge in aviation. Hong Kong can play a vital role in the aviation industry to promote domestic and international dual circulation.