Blockchain has developed into a new disruptive network technology since Bitcoin started to gain popularity on the international market in 2008. It was predicted that the impact of this innovative financial technology will be comparable with the Internet. Given such a trend, how can businesses afford not to have knowledge of this technology?

ASTRI: Blockchain to subvert the tradition of business community

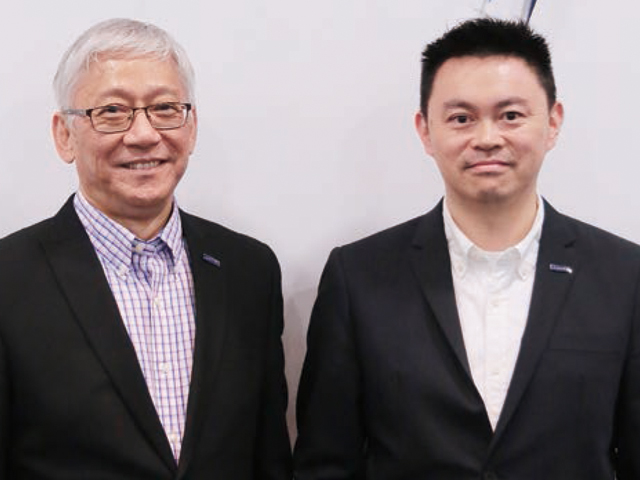

Frank Tong, Chief Executive Officer of the Hong Kong Applied Science and Technology Research Institute (ASTRI), hopes that they are able to provide two to three blockchain application services for the market in the next three years. Duncan Wong, Vice-president (Financial Technologies) of ASTRI, elaborated that blockchain is characterized by ‘cannot be changed’ and ‘difficult to attack’, which enable it to subvert the tradition of the business community.

Cannot be changed and difficult to attack

The most important characteristic of blockchain is that it cannot be changed. Wong said that blockchain is special in that “addition is allowed, but not subtraction”, i.e., once data are added, they can neither be changed nor removed.

He explained that many important documents, such as legal, financial and trade documents are still not yet digitized today because ordinary databases are vulnerable to tampering, thus hindering security. Blockchain can better ensure security since it cannot be changed. Buyers and sellers can still securely transact with each other even in the absence of a third-party intermediary. Hence The Economist regarded it as a “credible tool”.

Wong added that another characteristic of blockchain is its reliable distributed system that can withstand hacker attacks. Blockchain data are not stored in one place, but distributed in numerous “nodes”. “Even if a node is attacked by hackers, the data remain in the tens of millions of nodes and will not be lost.”

Two benefits for the business community

Wong believes that blockchain can bring two benefits for businesses: cost reduction and efficiency improvement. When blockchain has become widely adopted, buyers and sellers can directly trade with each other without an intermediary. Traditional banks may be affected. However, Wong pointed out that the banks can still find new opportunities as long as they transform and upgrade.

Wong believes that blockchain can bring two benefits for businesses: cost reduction and efficiency improvement. When blockchain has become widely adopted, buyers and sellers can directly trade with each other without an intermediary. Traditional banks may be affected. However, Wong pointed out that the banks can still find new opportunities as long as they transform and upgrade.

Wong said: “Blockchain is a catalyst – one that accelerates digitization.” “Digitization” is in fact “to become paperless”. “After becoming paperless, businesses no longer need to allocate manpower to verify, wait or contact each other in order to follow up on their transactions. They can also shorten the time needed to exchange documents.”

He added that contracts stored in the blockchain are called “smart contracts”. Their information and status can be updated as the transaction progresses.

Knowing more to profit from change

Wong stressed that blockchain is different from the Internet revolution. Blockchain, compared with Internet, is a back-end technology that normal users may not notice at all. However, the revolution that the business community will experience in the future will definitely be no less than the arrival of the Internet.

So, how should businesses transform themselves in order to profit from this revolution? Wong said that the first task the business community should do is to acquire relevant knowledge and provide training for professionals in blockchain applications. He also pointed out that other countries are studying the application of blockchain technology in various areas, such as copyright management, payment systems and public services. As for Hong Kong, our focus is on the financial sector, which is Hong Kong’s traditional strength.

Progressing in steps and complying with regulations

Turning to the application level, Tong disclosed that Hong Kong Monetary Authority (the HKMA) has recently commissioned ASTRI to prepare a white paper on blockchain technology to study its application on trade financing. In his view, it is beneficial to work with the HKMA because the authority also wants to understand how the existing laws and regulations can support the development of the new technology.

Tong plans to give priority to developing application services that are less controversial. “For instance, the theme of the project we are currently working on with Bank of China is property valuation, which is an easier direction of development for the public to accept.”

William Gee: A new order to emerge as new technology matures

William Gee, Fintech Partner of PricewaterhouseCoopers China, pointed out that the new business mechanism arising from blockchain technology has the ability to disrupt the business models of different companies. “Now, when discussing blockchain, many people will say it is a disruptive technology. Indeed, what blockchain will disrupt is the reliance on ‘intermediary’ in the traditional business model.”

A new model that forgoes intermediary

At present, we will only transact directly when dealing with small-value transactions, e.g. shopping at a wet market. Thus, at the intermediary level, blockchain is a mechanism to build mutual trust between parties of transactions, reducing the involvement of intermediaries and the associated costs.

At present, we will only transact directly when dealing with small-value transactions, e.g. shopping at a wet market. Thus, at the intermediary level, blockchain is a mechanism to build mutual trust between parties of transactions, reducing the involvement of intermediaries and the associated costs.

Financial and non-financial applications

One of the characteristics of blockchain is that the more participants involve in it, the more benefits they would get. The cross-border payment platform in the banking sector is a case in point: the value the platform brings will multiply if more banks participate in it.

Gee explained that a new technology has to go through more or less the following stages of development: At first, people will have high expectations of the new technology, and then become disappointed when they slowly find out that there is a gap between what can be achieved and what is desired. Later on, with the emerge of real applications, a direction for development begins to surface, subsequently reaching a plateau of productivity.

Regulatory limitations and uniform standards

With many people discussing the pace of technological progress in various regions, Gee believes that the development of technology needs to take into account the laws and regulations of the respective regions.

With many people discussing the pace of technological progress in various regions, Gee believes that the development of technology needs to take into account the laws and regulations of the respective regions.

At the commercial level, Hong Kong is heavily affected by the Mainland; but with the differences in legal systems between Mainland and Hong Kong, any cross-border application of blockchain technology would require legal co-ordination between the two places. This would also depend on how the regulators of both places will allow and support cross-border transactions. Therefore, in some specific areas, it is not sufficient for Hong Kong to develop the technology alone if both places are to achieve cross-border application.

Gee pointed out that it is very important to establish a set of common technical standards if the two places are to develop their own blockchain technology. If not, they may not be able to link up with each other due to technical or regulatory differences.

New technology New thinking

Gee admitted that during his research in the past, he would often reflect on this question: Is blockchain suitable for everything?

In his view, blockchain is neither an application nor a system; it is a new business model and thinking. Thus, what is created through blockchain is not a platform, but an ecosystem. There are already many companies using blockchain in order to standardize internal exchange of information. If these companies and their competitors jointly develop and use blockchain, they will be able to form a large ecosystem.

If the international payment process can be streamlined, it will help reduce service costs, which is beneficial to both businesses and customers. Nevertheless, Gee pointed out that while blockchain will in principle lead to removal of the intermediary, it is still essential to have an intermediary in some cases, but its role will change. He believes that a company adopting a forward-looking approach to accept this technology is involved in changing the rules of the industry. On the other hand, a company failing to adapt to changes in technological trends will have fallen too far behind by the time it wakes up. This, then, is the impact of new technologies such as blockchain.